My Money MD | Shirley M. Mueller, MD

A few weeks ago, I gave a lecture in Paris entitled “Art: For Love or Money?” It was in association with Deloitte S.A. Luxembourg’s third annual “Art and Finance” conference regarding the art market and finance. The two intersect because studies by Rachel Campbell, assistant professor of finance at Maastricht University in the Netherlands and others show that holding 5% of a portfolio in an art fund results in a positive for return over time, at least for high-net-worth individuals (people with net worth of $30 million or more).

At the conference, Thierry Hoeltgen, the lead partner of Deloitte Luxembourg, made a surprise announcement (at least it was a surprise to me). Deloitte wants to bring the art-fund concept to the average investor. The scheme is evidently preliminary, as no details were given. Nevertheless, what we know about art funds for the wealthy is likely applicable. Art adds diversification to an investment portfolio in that it has low correlation with stocks – when stocks go up or down, art does not necessarily follow.

Art as an alternative investment has been promoted by Jianping Mei, a professor of finance at the Cheung Kong Graduate School of Business in Beijing, China, and by Michael Moses, previously an associate professor of management and operations at NYU Stern School of Business. The two launched a company called Beautiful Asset Advisors LLC, which created the Mei Moses Art Indexes based on the researchers’ data. The index tracks returns on some 15,000 objects that have been repeatedly sold in major auctions over the past 75 years, according to the Wall Street Journal.

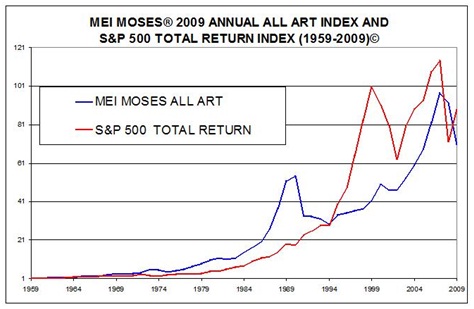

This graph indicates that currently the All Art Index is back to 2005 levels, while the S&P Total Return is hovering near levels it hit in the early part of this decade.

The 2008-09 downturn in the art market occurred after logging strong returns since the late 1990s, though not always in tandem with the S&P 500. This is, of course, why Campbell and others find low art and stock market correlation.