Mar 22, 2012 | My Money MD | Shirley M. Mueller, MD

Editor: Shirley learned the hard way that sellers should beware too! Read about the troubles she and others have run into.

Anyone with Chinese art around the house, whether purchased before 2000 or inherited from the family, might want to take a closer look to determine its current vale. The Chinese art market is hot right now as nationals are buying back their heritage that was exported abroad.

In 1984 I purchased a lacquer box at a “going out of business sale” at a reputable NYC Madison Avenue shop. At the time I bought it both because it seemed like a good deal and I liked it.

“Send it in,” the Asian art specialist at Christie’s said to me. “The Chinese are buying.”

He was referring to the recent upswing in sales to Chinese collectors at Christie’s and other auction houses. I had a Chinese cinnabar lacquer box that consequently might sell well.

The large carved red lacquer globular box and cover that I sent to Auction. Ming Dynasty, late 16th/17th century. Courtesy Christies.

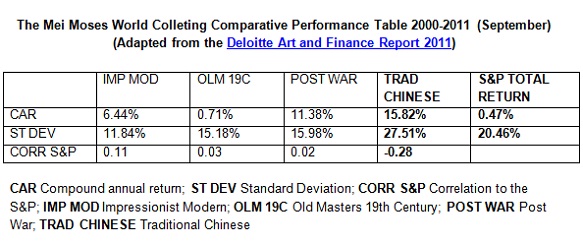

Indeed, the Chinese are buying. According to the Mei Moses Index, a respected art buying guide, the purchase of traditional Chinese art burst forth like an Asian firecracker during 2000 to 2011. It achieved a compound annual return of 15.82% compared to 0.47% for Standard and Poor’s 500 Index (the leading indicator of the U.S. equity market).

The Mei Moses World Collecting Comparative Performance Table 2000-2011 (September) above shows the returns of the S&P and the Traditional Chinese market on the right in bold. The traditional Chinese market is composed of art that the Chinese produced for themselves rather than export to the West. Still, some of it was exported abroad. All categories lagged behind the Traditional Chinese, in part because the recession in Europe and the U.S. diminished buyers in the impressionist, old masters and post war categories in which these countries commonly purchased.

Read more at: http://www.hcplive.com/physicians-money-digest/columns/my-money-md/03-2012/The-Chinese-are-Buying#sthash.07dHzGyF.dpuf